By definition, term life insurance policies come to an end. But permanent policies such as whole life insurance typically provide a lifetime death benefit, regardless of your health, as long as you pay the premiums to keep the policy in force.

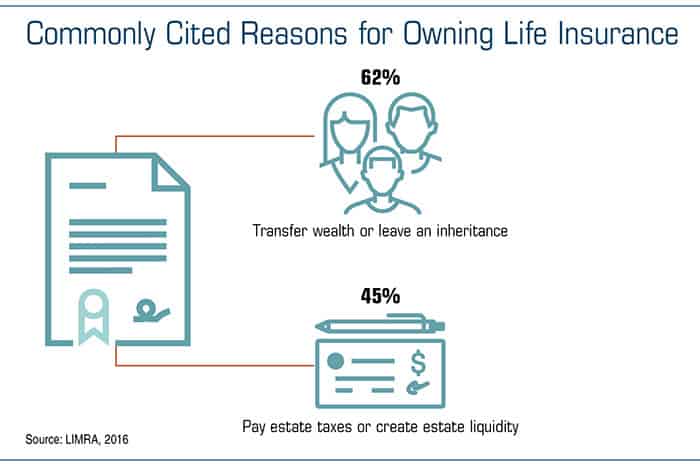

Thus, a whole life or survivorship life policy could play an important role in your estate plan. The death benefit could fund an inheritance for your loved ones or a charitable bequest. It could also provide liquidity that may be needed to divide estate assets equally among your children or meet potential estate tax obligations. Having cash available could help prevent your heirs from being forced to sell important assets they may prefer to keep, such as a family home, farm, or business.

Financial Flexibility

With a whole life policy, a portion of each premium goes into a cash-value account that accumulates on a tax-deferred basis. This could increase the death benefit over time if left within the policy. You may also access the cash value during your lifetime to help pay for retirement, college expenses, health care, emergencies, or other needs. Still, individuals generally should have a need for life insurance protection and evaluate a policy based on its merits as such.

You can generally make tax-free withdrawals (up to the amount paid in premiums) or use loans to tap into the accumulated cash value. Although policy loans accrue interest, they are free of income tax (as long as they are repaid) and usually do not impose a set schedule for repayment.

But keep in mind that loans from a life insurance policy will reduce the policy’s cash value and death benefit, could increase the chance that the policy will lapse, and might result in a tax liability if the policy terminates before the death of the insured. Additional out-of-pocket payments may be needed if actual dividends or investment returns decrease, if you withdraw policy cash values, or if current charges increase.

Insurance for Two

A survivorship life policy may be a good choice for couples who want to leave money to heirs only after both have passed away. This type of policy insures the lives of two people, typically a married couple, and pays a death benefit after the death of the last-surviving covered person. For this reason, it is sometimes called second-to-die insurance.

Because the premium for survivorship insurance is based on joint life expectancy, the cost is usually less (per thousand dollars of death benefit) than it would be for a policy covering either life alone — and significantly less expensive than buying two separate policies. Keep in mind that after the death of the first insured party, the survivor typically must continue paying the insurance premiums.

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. If a policy is surrendered prematurely, there may be surrender charges and income tax implications. Any guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company.

Before implementing a strategy involving life insurance, it would be prudent to make sure that you are insurable.

Comments are closed.