In late June 2017, a time when U.S. market indexes were at near-record highs, 65% of investment managers thought the U.S. stock market was overvalued. By contrast, 86% thought European stocks were undervalued, and 88% thought stocks in emerging markets were undervalued.1

At the same time, a majority of investment managers felt that U.S. corporate and economic fundamentals were strong, and more than a third believed that the U.S. market was fairly valued or undervalued.2

While large-scale professional investors may swing back and forth between favoring domestic or foreign stocks, the question for most individual investors is what role, if any, international stocks should play in a long-term investment strategy.

Growth Potential and Diversification

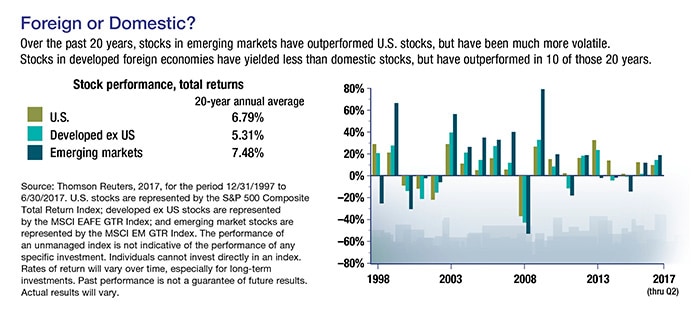

Emerging markets and developing economies account for about three-fourths of global growth, and growth prospects are looking up for more advanced economies outside the United States.3 Investing globally provides access to some of these growth opportunities and could help diversify your portfolio, because domestic and foreign stocks tend to perform differently from year to year (see chart). Diversification is a method to help manage risk; it does not guarantee a profit or protect against loss.

Although foreign equities can be part of a diversification strategy, keep in mind that nearly half of the earnings of large U.S. companies comes from overseas, so you may already have exposure to foreign markets.4

Additional Risk and Volatility

All investments are subject to market volatility, risk, and loss of principal. However, investing internationally carries additional risks, such as differences in financial reporting, currency exchange risk, and economic and political risk unique to a specific country. Emerging economies might offer greater growth potential than advanced economies, but the stocks of companies located in emerging markets could be substantially more volatile, risky, and less liquid than the stocks of companies located in more developed foreign markets.

Funds Across the World

The most convenient way to participate in global markets is by investing in mutual funds or exchange-traded funds (ETFs). There are broad global funds that attempt to capture worldwide economic activity, funds limited to developed nations or emerging economies, regional funds, and funds that focus on a single country. The term “ex US” or “ex USA” typically means that the fund does not include domestic stocks, while “global” or “world” funds may include a mix of U.S. and international stocks.

The return and principal value of all stocks, mutual funds, and ETFs fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Supply and demand for ETF shares may cause them to trade at a premium or a discount relative to the value of the underlying shares.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.